July 2025

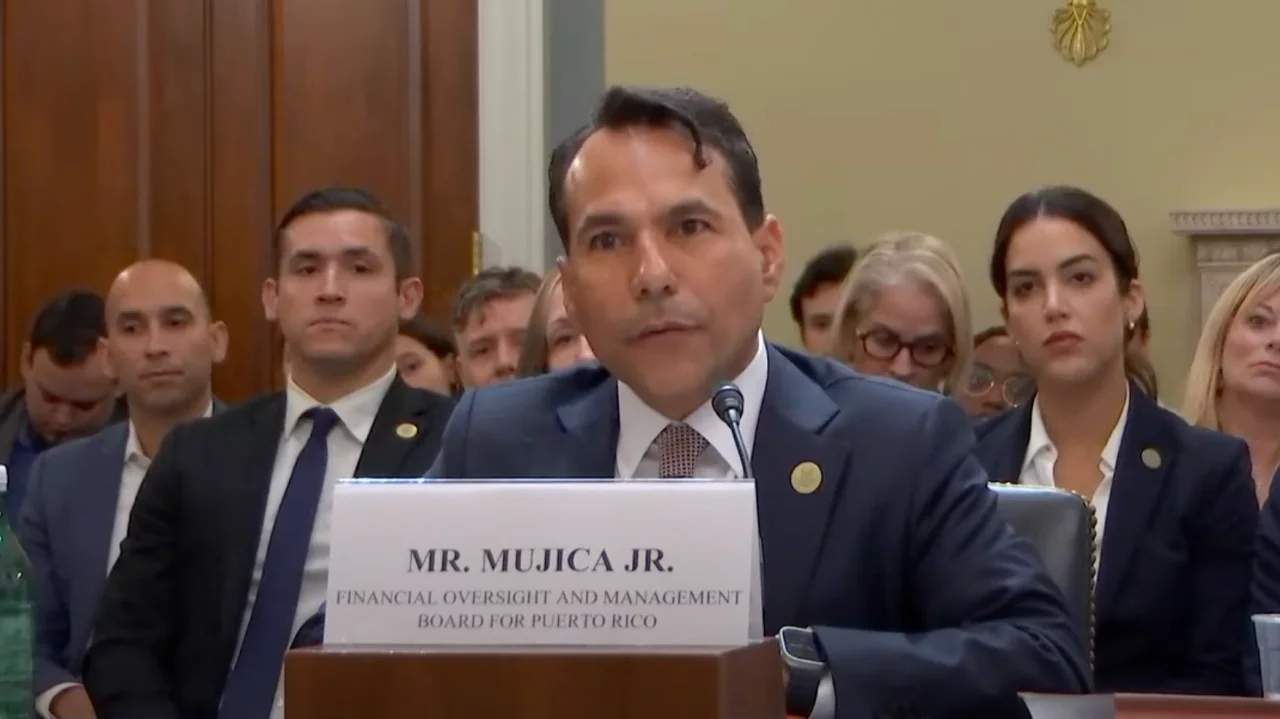

By and large, the FOMB made the case that they are important and should not be summarily done away with by Congress. In testimony in front of the House Committee on Indian and Insular Affairs on July 16, Oversight Board Executive Director Robert Mujica successfully prosecuted the argument that despite challenges, delays, mounting natural disasters and political battles, the FOMB is a value-add and its removal would be a grave mistake.

In one powerful exchange between Resident Commissioner Pablo José Hernández, Puerto Rico’s non-voting member of Congress, and the head of FOMB, the Representative pressed on how many billions of dollars PROMESA has cost tax payers, $2b, $4, more? Mujica defended these high costs with agility. The costs of PROMESA are signifi cantly outweighed by the $60+ billion in savings associated with fi scal responsibility, contract renegotiation, and government institutional cultural change. (No small feat).

Watching the hearing, there are some key themes that come up:

- What is the appropriate cost-savings ratio?

- How do you get out of the PREPA bankruptcy mess?

- How do you actually promote economic development in Puerto Rico?

Cost-Savings

Ratio Robet Mujica cited a $1.4 billion fi gure when asked directly about how much PROMESA has cost the public. This number was countered immediately by Rep. Hernández, Puerto

Rico’s Resident Commissioner, who brought up recent reports that consultants alone have cost more than that. For the sake of simple math, let’s presume that PROMESA, the FOMB, consultants and all have cost around $5 billion. If we take Mujica’s account as accurate, this has produced over $60 billion in savings, effectively rescuing the government of Puerto Rico from its worst instinct (entering into noncompetitive contracts poorly) and implementing operational changes that save money and reduce spending. Is that enough? Should we be pushing for a 1:20 instead of the 1:12 that the FOMB cites? Are we satisfi ed with $1 in for $12 dollars saved?

Keep in mind that the entire GNP of Puerto Rico hovers around $100 billion, so saving $60 billion is by no means negligible. If that type of expense, however, is far from where some who would otherwise abolish the FOMB would like it to be, what is the acceptable number? I fear that the numbers do not fi gure into their account. Noteworthy that several Democrats, like Alexandria Ocasio-Cortez, regularly considered a champion for Puerto Rico on the left, stood up to defend the FOMB’s existence.

PREPA Bankruptcy

The other major theme was electric power rates and the extortionary behavior of certain PREPA bondholders. Despite Mujica repeatedly clarifying that it is the whole body of dissenting bondholders that are opposing to a $2.6 billion settlement and demanding a full payment plus interest (somewhere closer to $12 billion), the Committee’s Democrats homed in on GoldenTree Asset Management. GoldenTree is estimated at holding around $1 billion of the outstanding $8.3 billion debt, not including pensions.

The other bondholders, including BlackRock, are willing to make a deal, based on limited net revenues and establishing a 50-year partnership to recover some losses. The GoldenTree alternative represents a 10.5 ¢/kWh permanent increase in the rate to cover

bondholder payment. That doesn’t even get into the ongoing rate case that promises to raise the rate some 11¢/kWh to cover base operational costs.

The bottom line is that Puerto Rico residents are facing an incredibly high rate or a ridiculously high rate. There are only less-bad options, nothing good. Regardless, the rate must refl ect the actual costs of doing business, and the risk is that the rate is too high to do business.

Economic Development

Speaking of doing business, Mujica referenced what is already happening, and what happened in the 50s in the US and everywhere there’s a high tax regime in place: people will fi nd a way to avoid the cost of doing business. Either they leave the grid or they leave the island, but as a recent blog post by Severin Borenstein put it, “every electricity demand reduction is a cost shift.” If people are faced with the options of paying high rates for unreliable power or lower rates for more reliable power, it doesn’t take an economist to fi gure out which path they’ll choose.

The question is, how do you get out of bankruptcy without imposing signifi cantly higher cost of living penalties? There a few examples (San Bernandino, Stockton, Detroit, Vallejo), but none look quite look like the challenges that Puerto Rico faces.

What does it say to the investment community when the government issues a noncompetitive public tender? Or when they award the contract to a noncompetitive bidder? Or when that contract is canceled or paused by the FOMB after it was awarded?

It doesn’t say anything good; doesn’t inspire confi dence in new investors to participate. Same thing goes for LUMA’s contract, which is increasingly under threat.

Emerging from bankruptcy without signifi cant cost of living costs requires a few things to occur: reasonable debt restructuring, operational effi ciencies and cultural changes in governmental institutions, and economic development. The idea is that you reduce what you owe, you reduce costs to provide more or less the same services with a lighter burden, and you diversify the tax base so that new businesses help boost revenues without relying exclusively on existing residents and businesses.

San Bernardino, as part of their 2012-2017 bankruptcy proceedings, radically reformed their pension programs. Small changes like 2% at 62 as opposed to 3% at 50, provided immediate relief. Are they popular? Not among the pensioners. Do they work? Undoubtedly.

Puerto Rico needs more than just four consecutive balanced certifi ed budgets. As Mujica succinctly argued in front of Congress, Puerto Rico faces the challenges of implementing structural changes that help make permanent a culture of fi scal responsibility. Teach the patient how to live a healthier life will represent a signifi cant cost reduction compared to healing the patient and treating them next month for the same disease.